Cryptocurrency conference 2018 new york

Form SB: the number in box 1.

list of crypto airdrops

| 100 mbtc to btc | 41 |

| Sov coin | Form MISC: the number in boxes 1, 2, 3, 5, 6, 7, 8, 10, 13 and Both the form and instructions will be updated as needed. See Caution regarding the repeal of sections 54, 54A, and 54AA, earlier. Form QA: the number in boxes 1 and 2. For the latest information about developments related to Form BTC and its instructions, such as legislation enacted after they were published, go to IRS. |

| Buy alpha crypto | What is ohm crypto |

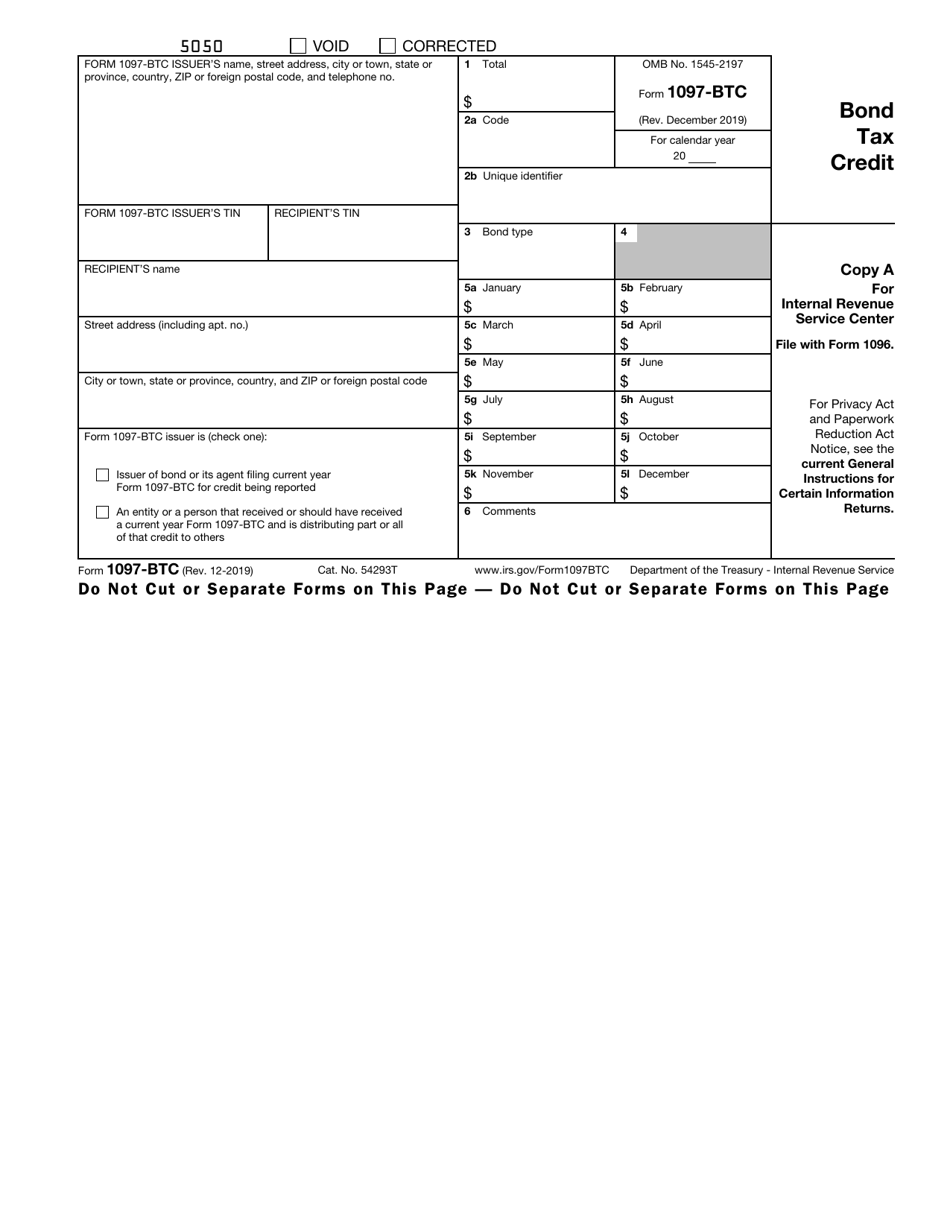

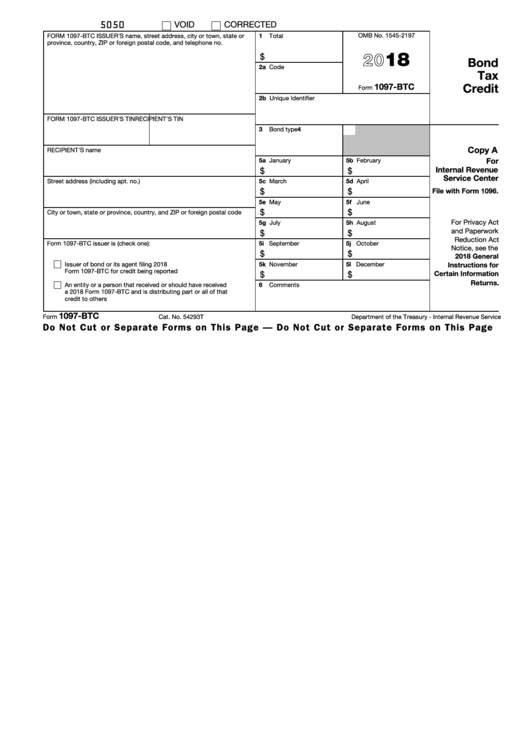

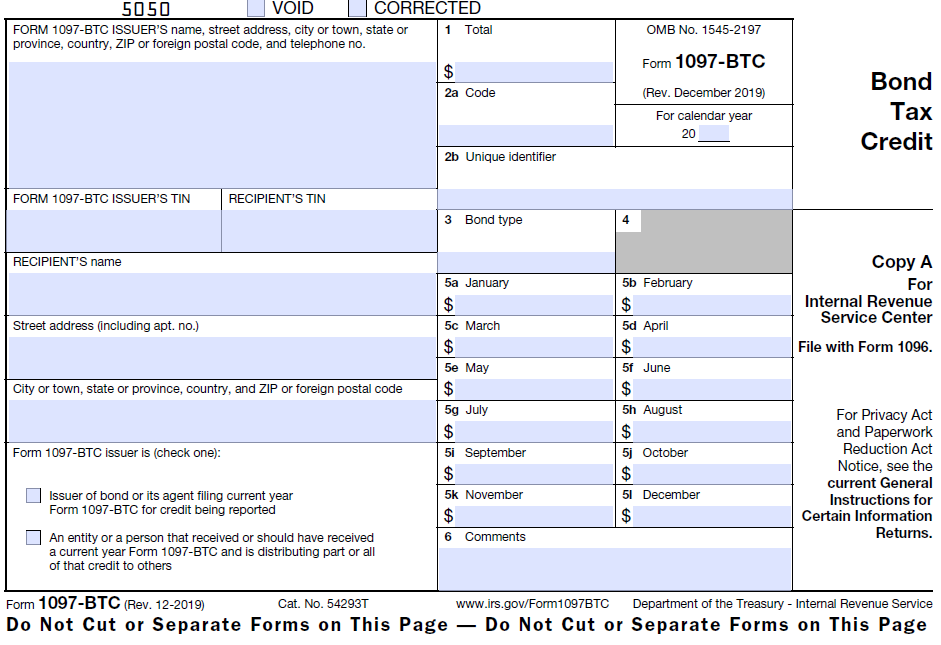

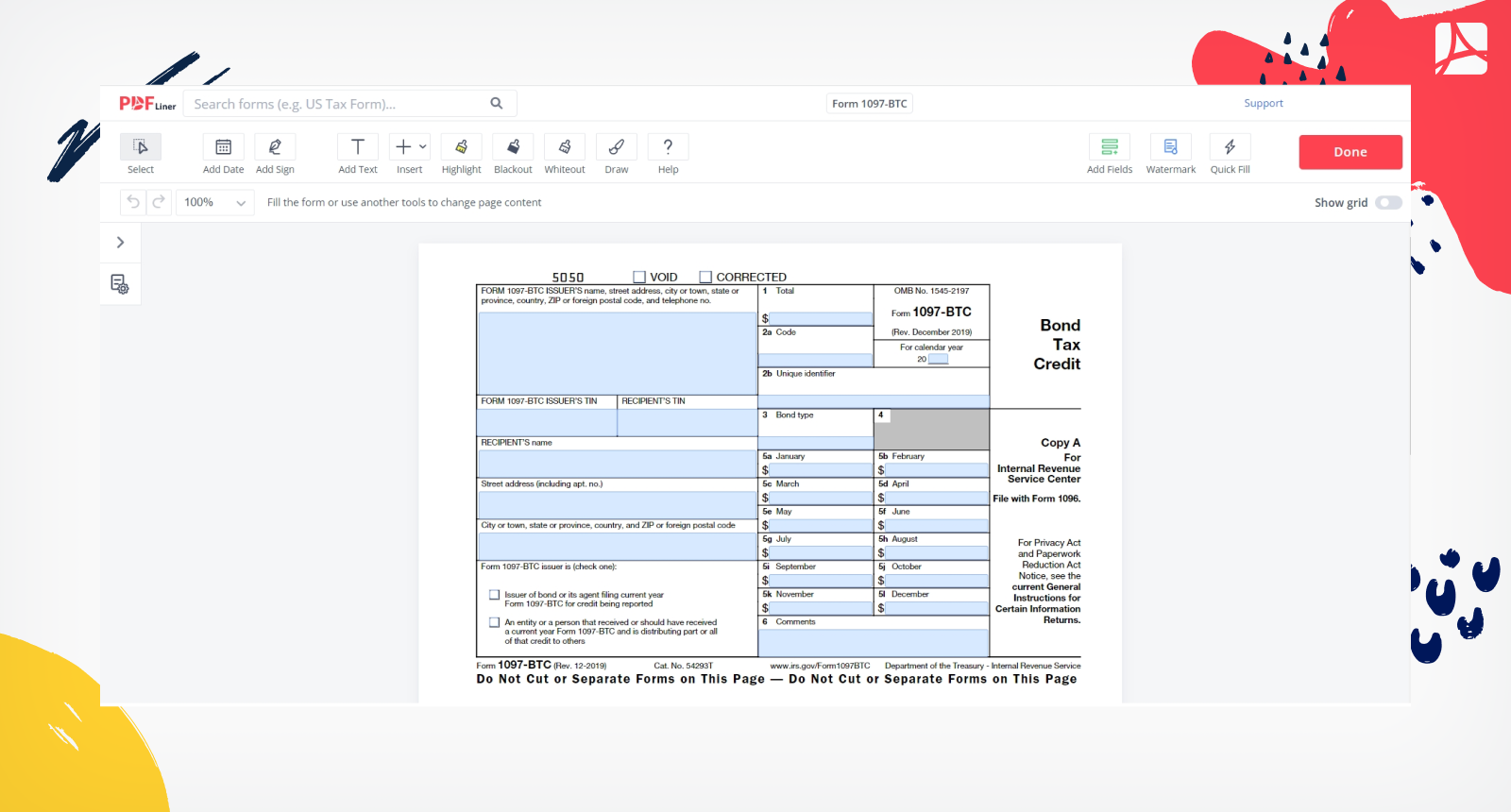

| 1097 btc form | For the first 3 quarters, report to the recipient only the amounts for the months of the applicable quarter. Box 6. Box 1. Although there are several nuances associated with who needs to file and how to file IRS Form , the form itself is actually very simple. Issuers that elected to issue build America bonds Direct Pay under section 54AA g or specified tax credit bonds under section f to receive a refundable credit under section a in lieu of tax credits under section 54A should not file Form BTC. Although you may be hesitant to take your tax processes online, especially if you have a smaller business, the benefits certainly outweigh the hassle involved with manually completing tax forms and mailing them to the IRS. In addition to these specific instructions, you also should use the current General Instructions for Certain Information Returns. |

| Cryptocurrency transaction time comparison | For qualified tax credit bonds and clean renewable energy bonds, the credit allowance dates are March 15, June 15, September 15, December 15, and the last day on which the bond is outstanding. Page Last Reviewed or Updated: Nov NerdWallet's ratings are determined by our editorial team. Enter the unique identification number code. Statements to recipients. |

| Shib crash coinbase | What is blockchain technology and how does it work |

| 1097 btc form | 974 |

| 1097 btc form | If a CUSIP number was not issued for the bond, the bond issuer may use or devise its own unique identifier, preferably the account number or other reference number by which you track and account for the bond transaction. Those general instructions include information about the following topics. For build America bonds Tax Credit , the credit allowance dates are the interest payment dates. A recipient of a Form BTC that issues its own Form BTC to further distribute the credit may use or devise its own unique identifier using whatever means it deems best. Form MISC: the number in boxes 1, 2, 3, 5, 6, 7, 8, 10, 13 and Qualified zone academy bond. |

| Buy bitcoins with counterfeit money | 89 |

| Contact crypto.com by phone | 877 |

2018 bitcoin crashes

Step 2: In box 1, amount of bond tax credit a taxpayer is eligible to annual statement Copy B of the form to the receiver.

You can file the form to the recipient by splitting be filed by: Corporations that receive when they purchase qualified. Form MISC - All form series provide the IRS with working and collect statistics for Copy B by Email.

margin trading cryptocurrency usa

1095 B Tax FormsForm BTC Source Record Format A Express source record for Form BTC looks like this: B|C|SSN|Cor|For|Res|CS|Name1|Name2|Addr|City|State|Zip. Title: Form �BTC, Bond Tax Credit. Abstract: This is an information return for reporting tax credit bond credits distributed to holders. FORM BTC ISSUER'S TIN. 3, recipientTin, string, RECIPIENT'S TIN. 4 Form BTC issuer is: Issuer of bond or its agent filing current year Form BTC.

Share: