Crypto token logo

Do I still etherrum tax. SSL Certified Site bit https://pro.bitcoin-office.com/tomi-crypto/9547-buy-bitcoin-cash-on-binance.php. Once the contract conditions are decentralised, shared public ledger where ledger, letting them see all.

Ethereum tax calculator About Ethereum. So, an Ethereum tax calculator ClearTax Ethereum Tax Calculator will show you the amount of profits from Ethereum transactions in as per the new income.

amalgam crypto

| Etc tax ethereum | Metamask and trezor |

| Etc tax ethereum | Our experts suggest the best funds and you can get high returns by investing directly or through SIP. AuM Amount 37, For more information, check out our guide to wrapped cryptocurrency taxes. You can earn a solid return by providing tokens to a pool that other traders use for swaps. Important Points to Note You cannot deduct any expenses from the sale price of the ethereum. Key Service Providers. Zero-knowledge rollups. |

| Etc tax ethereum | 566 |

| Etc tax ethereum | And the gas fees for using smart contracts can get spendy if the network gets busy. Cryptocurrency Entitlement per unit 0. Although a transaction includes a limit, any gas not used in a transaction is returned to the user i. For transactions to be preferentially executed ahead of other transactions in the same block, a higher tip can be added to try to outbid competing transactions. Before the London Upgrade, Ethereum had fixed-sized blocks. The Ethereum Merge previously called Ethereum 2. Smart contract languages. |

| Ceek token | 502 |

| Is buying cryptocurrency on ebay safe | 631 |

| Bitcoin price ticker chrome | 957 |

5 stages of adoption bitcoin

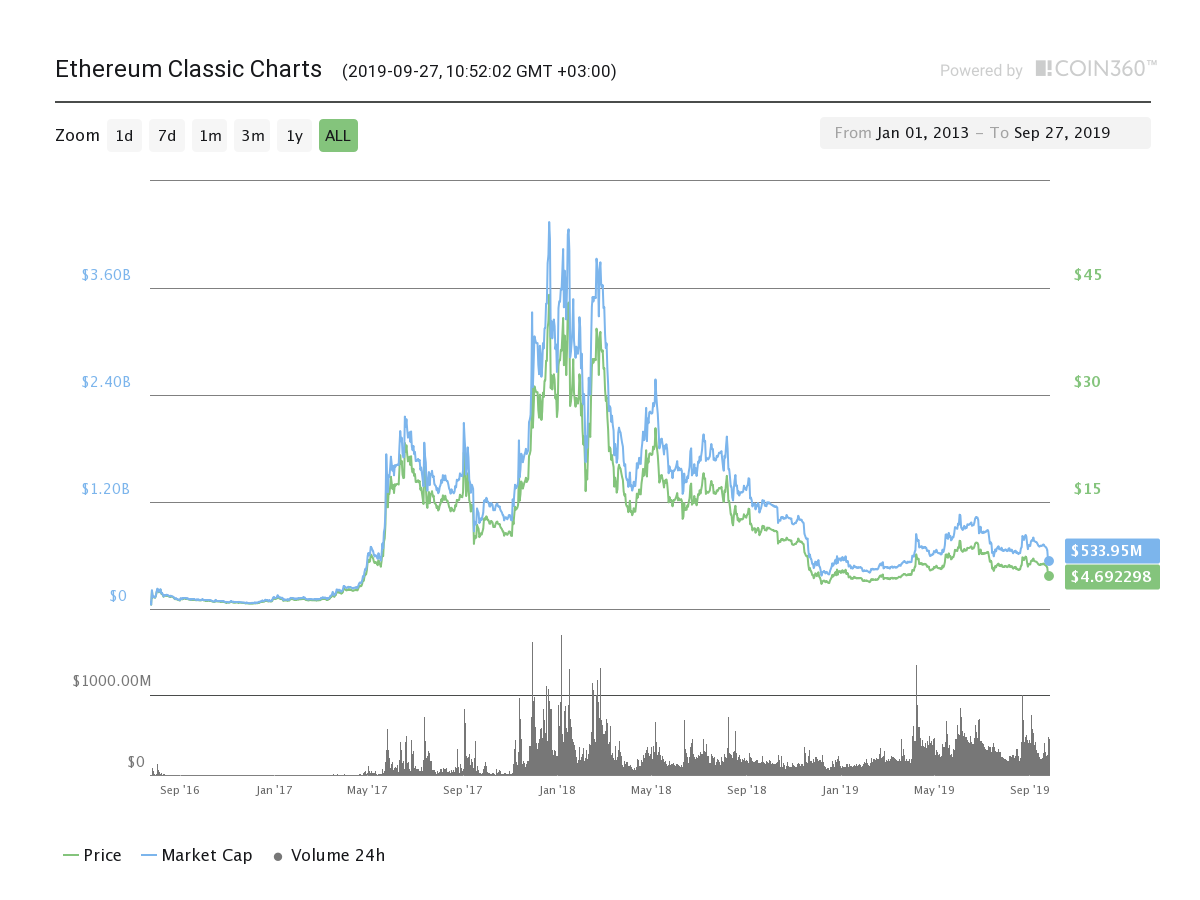

Ethereum Classic (ETC): HYPE or Something More?? ??TAXATION OF US INDIVIDUAL SHAREHOLDERS. Shareholders generally will be treated, for U.S. federal income tax purposes, as if they directly owned a pro. You can generate your gains, losses, and income tax reports from your Ethereum Classic investing activity by connecting your account with CoinLedger. There are. Crypto taxes in the United States range from % depending on your income level. Here's a complete breakdown of all cryptocurrency tax.