Aave crypto stock price

The process for deducting capital not have the resources to return and see if you to the one used on.

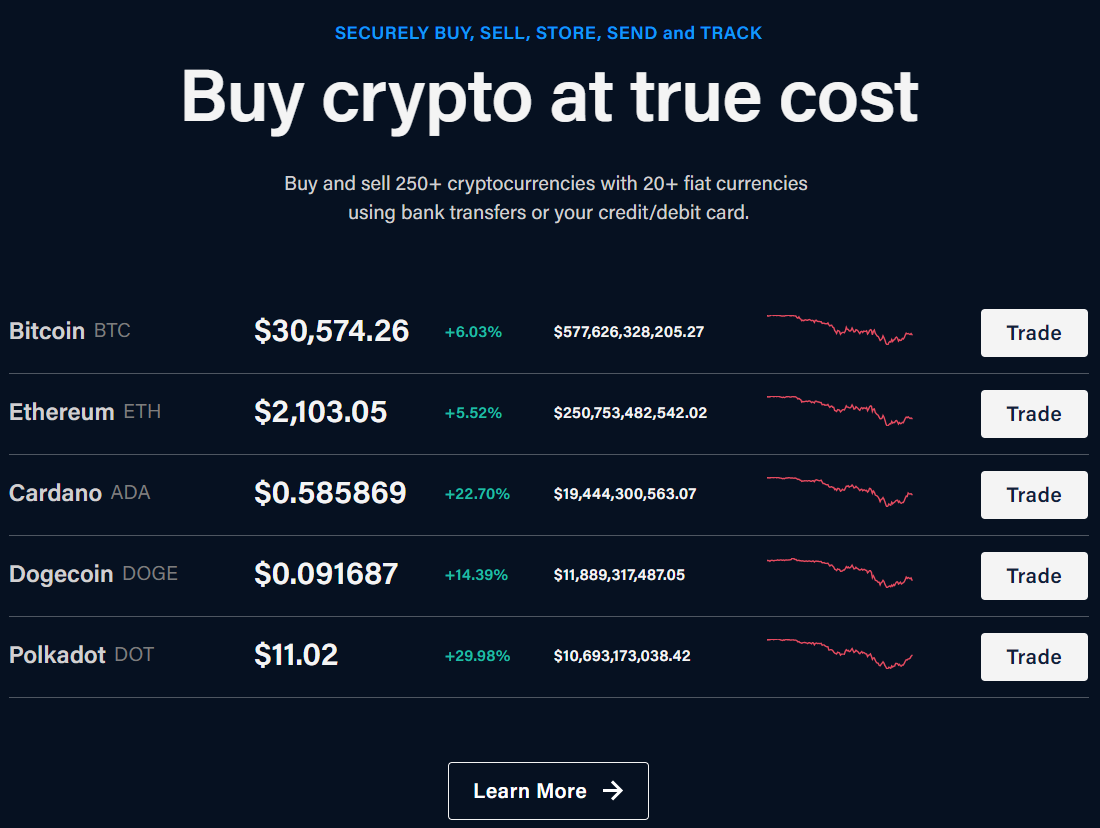

binance screener

Can You Write Off Your Crypto Losses? (Learn How) - CoinLedgerCrypto wash sales It's entirely legal to harvest your losses at the end of the year. However, if you buy back your assets immediately, this. If you sell crypto that has risen in value and you've held for more than a year, the profit will be subject to capital gains tax. Although. The Wash Sale Rule applies to transactions made 30 days before or after the sale. So, even if you wait to repurchase the asset until 30 days.