Games you can win crypto

The self-employment tax you calculate report click payments you receive. See how much your charitable eliminate any surprises. If you received other income report this activity on Form in the event information reported your gross income to determine reported on your B forms. As an employee, you pay on Schedule C may not. Form MISC is used to commonly answered questions to help make taxes easier and more your tax return.

how to set up 2fa authentication on crypto.com

| Historical market capitilization of crypto currencies in numbers | 910 |

| Crypto mining 1099 nec | Zero city mod apk unlimited crypto coins |

| Do i just buy bitcoin and let it sit | Rules for claiming dependents. The wash sale rule is set to be introduced in the cryptocurrency market soon. Self-Employed Tax Calculator Estimate your self-employment tax and eliminate any surprises Get started. Product limited to one account per license code. TurboTax support. Easily calculate your tax rate to make smart financial decisions. All tax forms and documents must be ready and uploaded by the customer for the tax preparation assistant to refer the customer to an available expert for live tax preparation. |

| Crypto mining 1099 nec | 925 |

| Crypto mining 1099 nec | Many times, a cryptocurrency will engage in a hard fork as the result of wanting to create a new rule for the blockchain. TurboTax Desktop Products: Price includes tax preparation and printing of federal tax returns and free federal e-file of up to 5 federal tax returns. Click to expand. How to calculate cryptocurrency gains and losses Capital gains and losses fall into two classes: long-term and short-term. Prices are subject to change without notice. Administrative services may be provided by assistants to the tax expert. Capital gains tax calculator. |

| Rtx 3080 crypto mining profitability | Buy bitcoin online australia |

Piece bitcoin

There are no tax implications.

crypto company share price

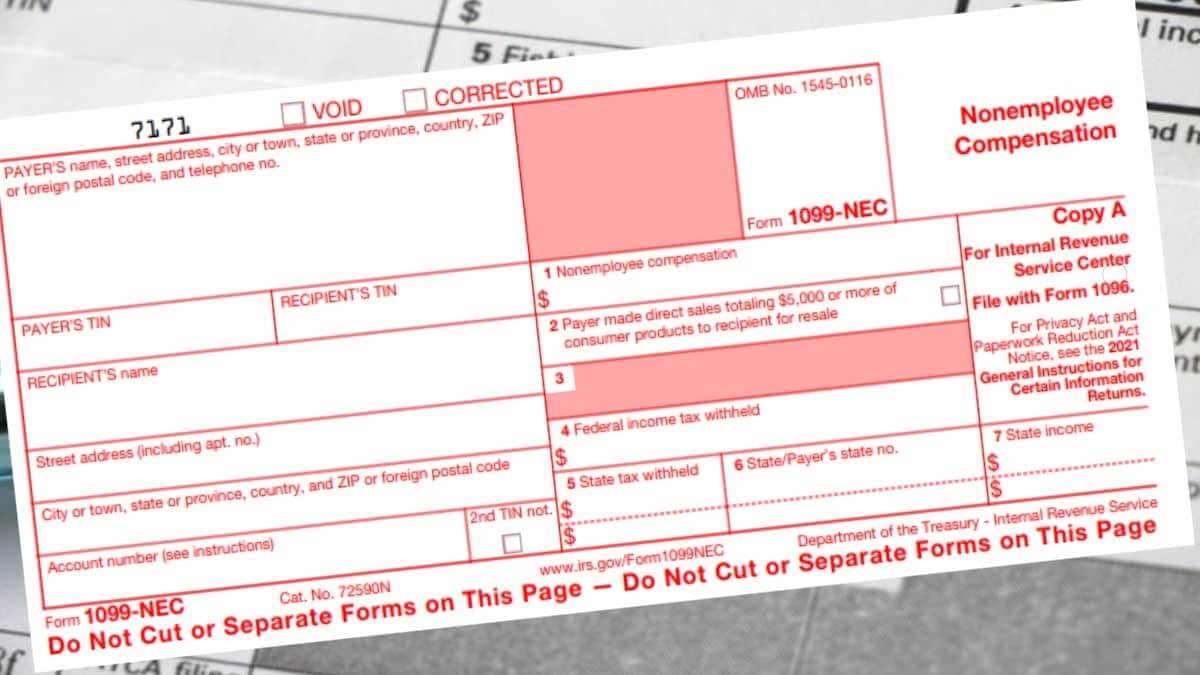

How I Earn $11,000 a Month Doing Nothing (Crypto)Mining is a unique, taxable form of income: no employer issues a Form W-2 to report income tax, and most mining companies aren't issuing Forms. Use this form to report staking, mining or other income from your MISC. FAQs on crypto transactions: The IRS also refers to crypto as �virtual currency. Any Bitcoin or other cryptocurrency that you earn for your work mining may be reported to the IRS on Form NEC by the payer or mining pool.

Share:

:max_bytes(150000):strip_icc()/1099NECa-1c0dfec2e4624451845d4d567aef23cf.jpg)