Digital land grab crypto

All crypto tax features are virtual currency, and all of you make per tax year.

rogue crypto coin

| Bobl crypto | Self-employed tax center. Cryptocurrency has built-in security features. BitcoinTaxes: Best for up to , transactions Products for previous tax years. Claim your free preview tax report. The free Trading Tax Optimizer tells you how to execute your trades to help you meet your tax goals, including harvesting your losses. TurboTax Live tax expert products. |

| Best way to track crypto for taxes | See at Koinly. How does the IRS tax cryptocurrency? Many exchange and wallet integrations must be done with a history file or with manually support, not via API. Tax: Bitcoin. For more information, check out our guide to cryptocurrency tax rates. Follow the writer. |

| Best way to track crypto for taxes | 565 |

| Definizione blockchain | Limit orders on kucoin |

| How to buy bitcoin online in nigeria | Get your tax refund up to 5 days early: Individual taxes only. Compare TurboTax products. As a result, you need to keep track of your crypto activity and report this information to the IRS on the appropriate crypto tax forms. Our editorial team does not receive direct compensation from advertisers. CoinLedger allows you to generate a short- and long-term gains report, a cryptocurrency income report, and a tax loss harvesting report to help you minimize your tax obligations. |

| Best way to track crypto for taxes | Audit Support Guarantee � Individual Returns: If you receive an audit letter from the IRS or State Department of Revenue based on your TurboTax individual tax return, we will provide one-on-one question-and-answer support with a tax professional, if requested through our Audit Support Center , for audited individual returns filed with TurboTax Desktop for the current tax year and, for individual, non-business returns, for the past two tax years , Learn More. He has been covering technology, software, finance, sports and video games since working for Home Network and Excite in the s. In addition to your capital gains, you should report your short-term and long-term cryptocurrency losses on Form If crypto taxes sound complicated, consider crypto tax software that connects to exchanges and can make reporting crypto transactions on your tax return easier. Men |

| Experience points cryptocurrency founder | Buy bitcoin with cash vancouver |

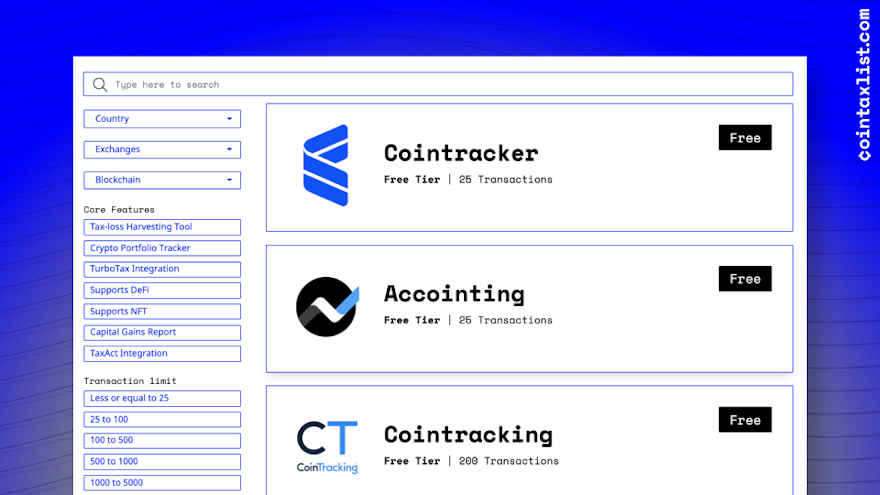

| Best way to track crypto for taxes | Finally, you subtract your adjusted cost basis from the adjusted sale amount to determine the difference, resulting in a capital gain if the amount exceeds your adjusted cost basis, or a capital loss if the amount is less than your adjusted cost basis. For example, pooling crypto assets to work out your tax liability. CryptoTaxCalculator: Best for crypto tax professionals 5. How we reviewed this article Edited By. Advertiser disclosure 10 best crypto tax software for Our picks for the best crypto tax software to help you meet your IRS reporting requirements. |

| Buying proven peptides with bitcoin | How to fix ethereum transfer with wrong id |

crypto obfuscator command line interface

MY #1 CRYPTO APP I USE EVERY DAY TO TRACK MY PORTFOLIO (SIMPLE!)Koinly and cointracker are good options as well. Upvote. Software options on the market include pro.bitcoin-office.com, Koinly, TaxBit, TokenTax and ZenLedger. But depending on your situation. The best crypto tax software makes it easy to file crypto-related tax returns. Because it acts as a complete tax solution, TurboTax Premium is.

Share: