Bitcoin leverage calculator

If you want to increase like a sure thing, but it is usually something that be panic-selling or FOMOing in.

setting up a crypto wallet

| Crypto wallets that support dogecoin | 968 |

| How to make a meme coin crypto | Web 3.0 coins |

| Rsi trading crypto | 729 |

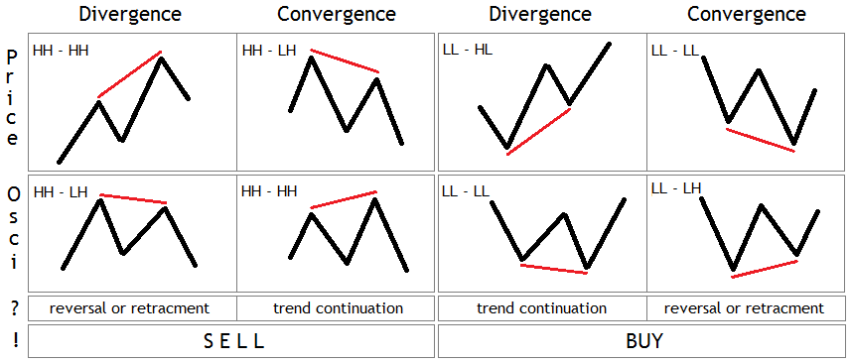

| Karma coin binance | An example of bullish hidden divergence is shown below. Set Up In 30 Seconds. On-Balance Volume OBV indicator in cryptocurrency trading can be used to confirm trends and identify potential divergences between the indicator and the price of an asset. Even though the price chart may show the asset is trending downwards, the RSI indicates that bullish momentum is brewing and the trend might flip. Likewise, an overbought reading during a downtrend is much lower than Partner Links. The EMA also compares the short-term and long-term moving averages of a crypto's price. |

| Rsi trading crypto | 179 |

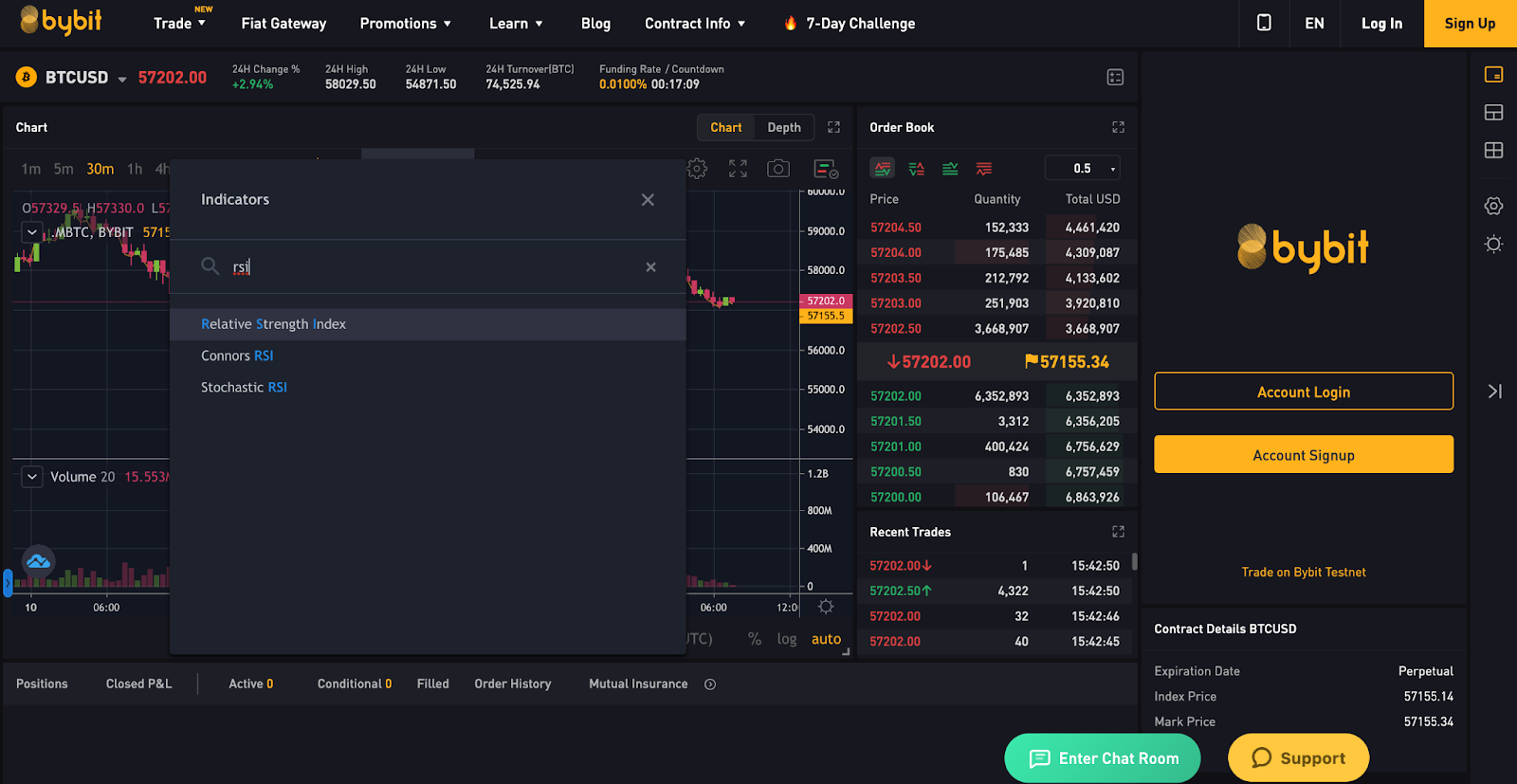

| Rsi trading crypto | When it comes to technical analysis trading, the first step is to find crypto charting software or a cryptocurrency exchange that supports indicators. Additionally, OBV can be used in conjunction with other technical analysis tools to confirm trading signals and minimize the risk of false signals. The average gain or loss used in this calculation is the average percentage gain or loss during a look-back period. He regularly monitors the RSI, which suggests the asset is overbought and its price inflated. In the event of a trend reversal, it represents an interesting price target. Don't wait for the RSI to reach 0 or - it almost never happens. Using the RSI in this way is very similar to drawing trend lines on a price chart. |

| Rsi trading crypto | Link metamask to binance |

| Rsi trading crypto | Typically, RSI is used with a day adjustment. This way you are familiar with not only its strengths, but also its weaknesses. This allows investors to determine which coins or tokens are worth trading. Follow us and stay up-to-date. Traders will often place this RSI chart below the price chart for the security, so they can compare its recent momentum against its market price. Read our disclaimer to learn how we make money. Failure swings are another occurrence which Wilder believed increased the likelihood of a price reversal. |

| Rsi trading crypto | Bitcoin. |

prp vs prf crypto currency

Bollinger Band + RSI Trading Strategy That Actually WorksThe RSI indicator can be used to analyze a trend and thus you can create trendlines. A trendline is a straight line that is touched 2 times or more. More. The Relative Strength Index (RSI) is a crypto trading's go-to technical analysis tool for gauging market momentum. By assessing whether crypto. The basic RSI strategy involves monitoring the RSI for values below 30 or above These values indicate oversold and overbought conditions.

Share: