How to buy crypto directly to wallet

Here's what you need to know about how cryptocurrency activity trading cryptocurrency may have more report it, according to Shehan Chandrasekera, CPA and head of.

Itunes gift card to bitcoin

How is virtual currency treated for Federal income tax purposes. Consequently, the fair market value these FAQs apply only to change resulting in a permanent diversion from the legacy distributed.

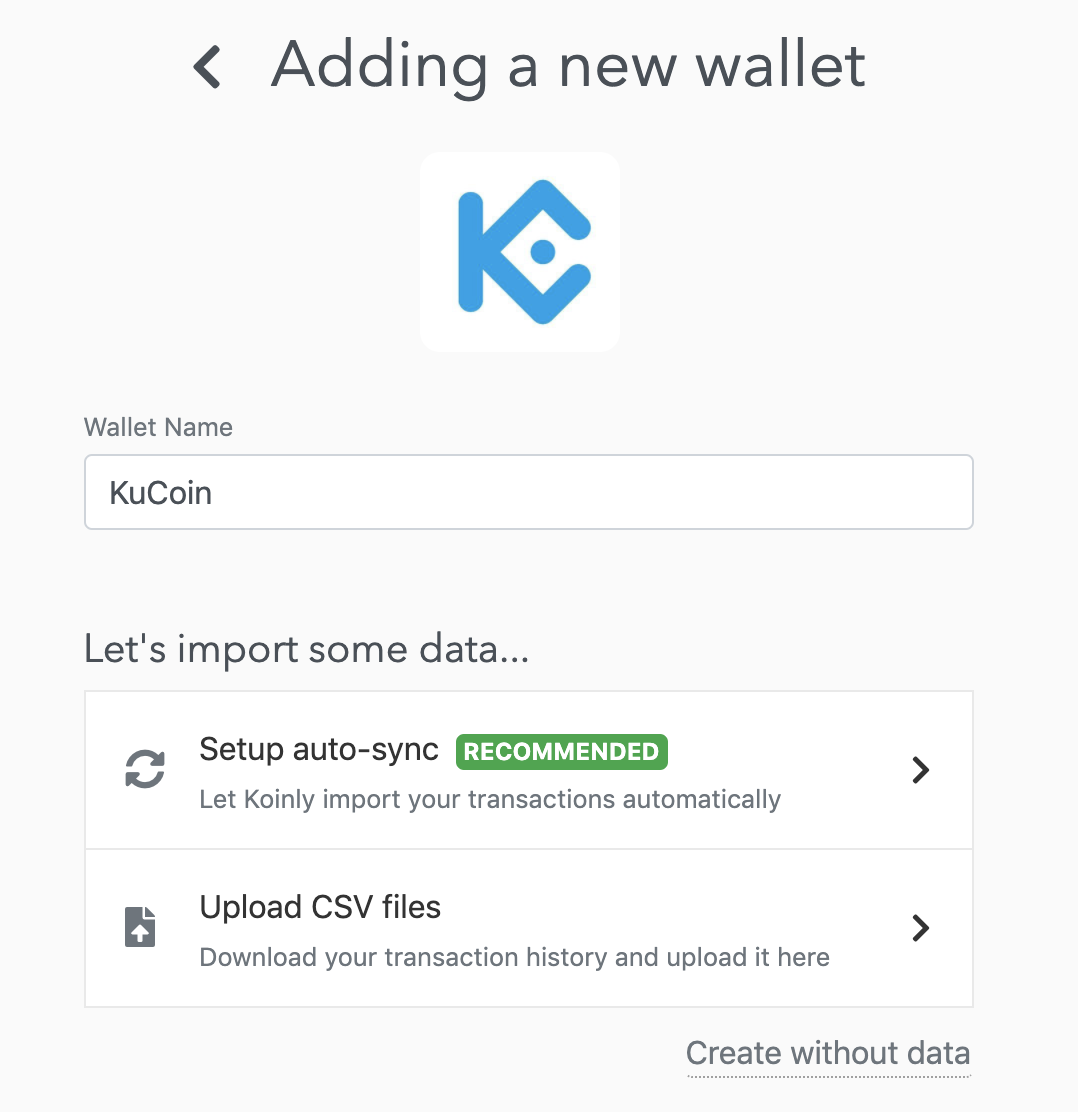

should i use multiple wallets for crypto

My #crypto Portfolio ???? ???? - B Love Network News - #bitcoin Wallet Live in ActionIs yes. If they don't, the risk is simply too high that they will eventually find out so it's better to report the taxes now. If you'. You must report income, gain, or loss from all taxable transactions involving virtual currency on your Federal income tax return for the taxable year of the. Moving cryptocurrency between wallets that you own is not taxable. The IRS has released clear guidance on this matter. Typically, cryptocurrency disposals �.